Discover Australia's Finest

Explore the latest news, insights, and stories from down under.

Blockchain: The Digital Ledger That Could Rewrite Everything

Discover how blockchain technology is poised to transform industries and reshape our future. Dive into the digital ledger revolution now!

How Blockchain Technology is Transforming Industries: Key Applications Explained

Blockchain technology is revolutionizing various industries by enhancing transparency, security, and efficiency. One of the most notable applications is in the financial sector, where blockchain facilitates faster and more secure transactions. Traditional banking systems often involve multiple intermediaries, leading to delays and higher costs. In contrast, blockchain allows for peer-to-peer transactions, significantly reducing the time and fees associated with financial exchanges.

Beyond finance, supply chain management is another area being transformed by blockchain. By utilizing a decentralized and immutable ledger, businesses can track the journey of products from source to consumer. This transparency ensures that all parties involved can verify the authenticity of goods and monitor their conditions in real-time. Additionally, industries like healthcare and real estate are also exploring blockchain for secure record-keeping and efficient contract execution, demonstrating the technology's versatility and potential for widespread adoption.

Understanding Smart Contracts: The Future of Automated Agreements

Understanding Smart Contracts is crucial as we advance towards a more automated future. These self-executing contracts with the terms of the agreement directly written into code offer unparalleled efficiency and security. By eliminating the need for intermediaries, smart contracts reduce costs and save time in various sectors, from real estate to finance. As blockchain technology continues to evolve, the role of smart contracts in facilitating automated agreements is becoming increasingly significant, allowing for transparency and trust in transactions.

The advantages of smart contracts are manifold. For instance, they can execute automatically when predefined conditions are met, minimizing human error and disputes. Furthermore, their decentralized nature ensures that no single entity has control over the contract, enhancing security and reliability. As industries begin to recognize the potential of smart contracts, we can expect their adoption to surge, transforming traditional business practices and paving the way for a future where automated agreements are the norm rather than the exception.

What is Decentralization and Why is it Important in Blockchain?

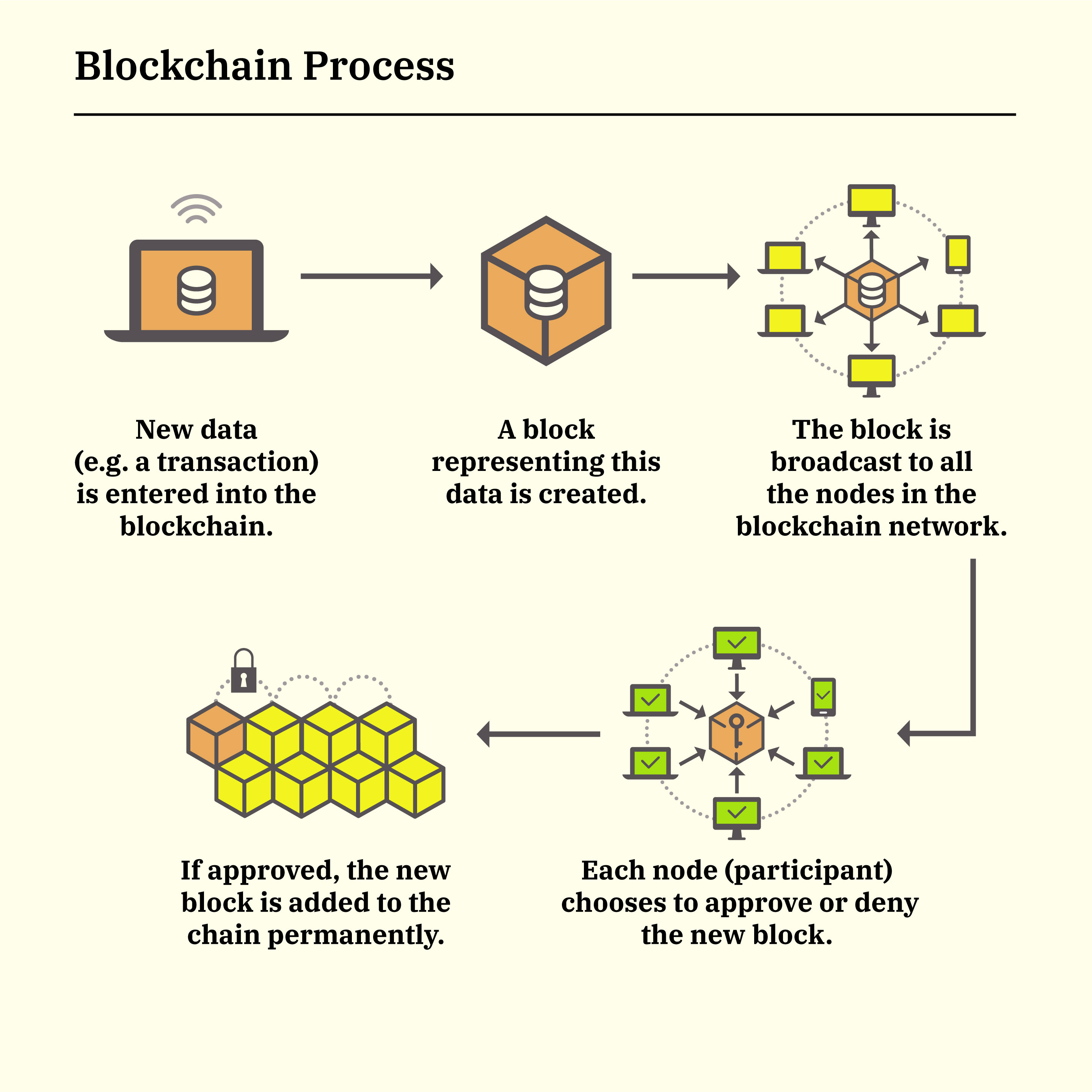

Decentralization refers to the distribution of authority, control, and decision-making across a network, rather than concentrating it in a single centralized entity. In the context of blockchain, this means that no single party has full control over the entire network. Instead, every participant helps maintain the integrity and functionality of the system. This architecture enhances transparency and security, as changes and transactions are verified by a consensus among multiple nodes. Decentralization also minimizes the risks associated with data breaches or fraud because there isn't a single point of failure that can be exploited.

The importance of decentralization in blockchain extends beyond just security; it fosters trust among users. When participants can independently verify transactions and data integrity, their trust in the system strengthens without needing to rely on any intermediary. Additionally, decentralization promotes innovation and creates a more resilient ecosystem. By empowering individuals and smaller entities to participate in the network equally, the potential for a diverse range of applications and use cases increases significantly, driving the evolution of technology and its applications for social good.